Create a Brighter Future, One Step at a Time

People with special needs often are heavily dependent on their families and loved ones to help them to live a full, enriching life. When you connect with Protected Tomorrows, you can be confident in knowing that we will give you the tools and guide you through the steps to make this happen.

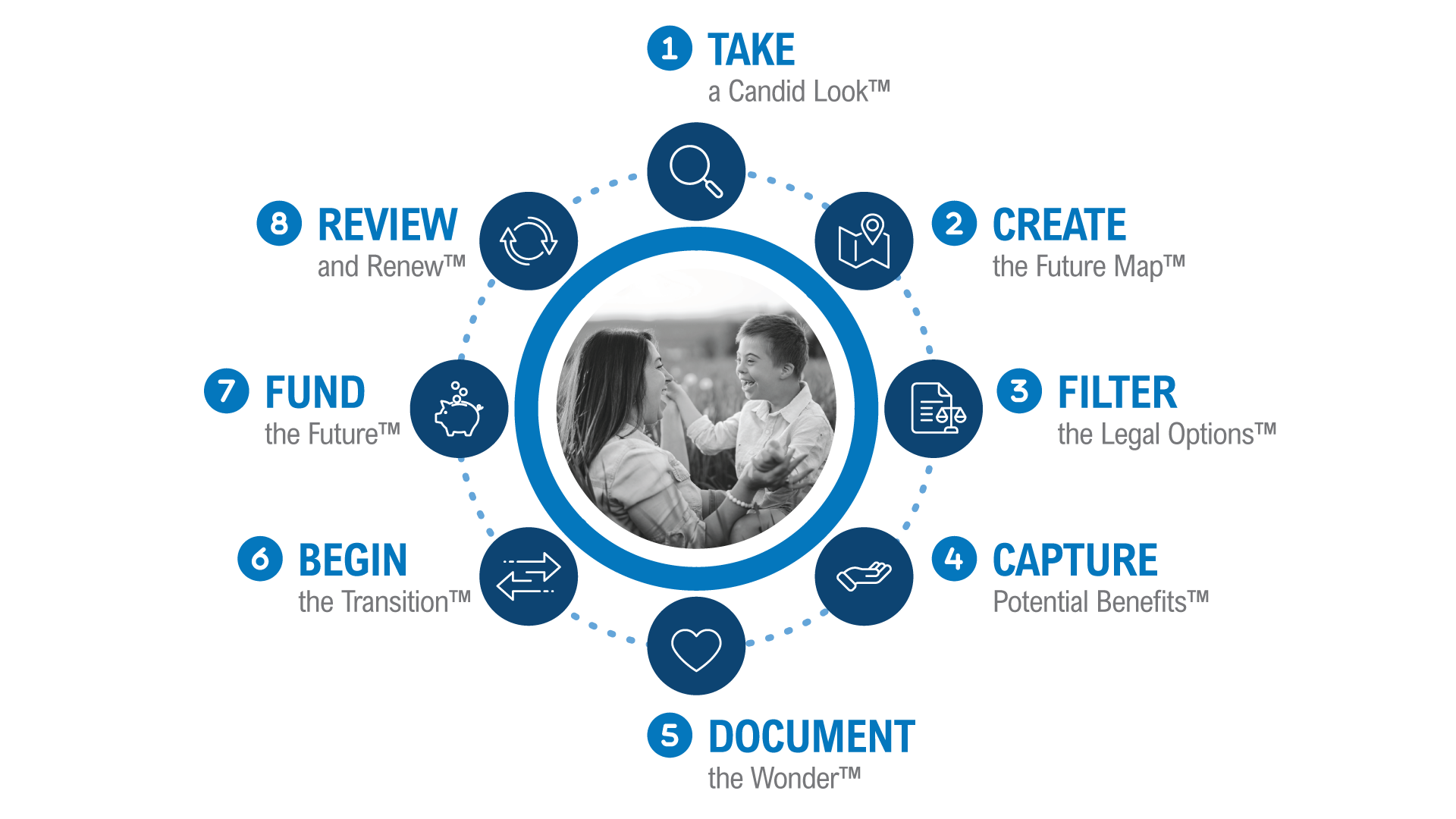

Roll Over An Icon To Learn More About Each Step.

Take a Candid Look™

Honestly and comprehensively assess your loved one’s current abilities, challenges, and anticipated future care necessities.

Create the Future Map™

Identify available options and outline a path to protecting your entire family’s future. Define goals, set priorities, and establish a plan for finances, long-term care, and future pivotal decisions.

Filter the Legal Options™

Consult specialized legal professionals to establish essential documents such as wills, family trusts, special needs trusts, guardianship arrangements, and powers of attorney to secure your loved one’s future care and financial security.

Capture Potential Benefits™

Research and identify the government benefits and programs available for your loved one, including Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), Medicaid, Medicare, and vocational and rehabilitation services.

Document the Wonder™

Chronicle your loved one’s journey and maintain detailed records of their medical history, preferences, abilities, and personal interests to provide valuable insights for future caregivers and support providers.

Begin the Transition™

Evaluate future opportunities for your loved one, including, transition planning services, educational opportunities, vocational training programs, employment options, and residential choices suited to their abilities and preferences.

Fund the Future™

Explore and secure funding options of special needs trusts, ABLE accounts, life insurance, and retirement planning strategies to ensure sufficient financial resources are available to meet your loved one’s long-term needs.

Review and Renew™

Regularly revisit and proactively update your care and financial plans to reflect changes in your loved one’s needs, family circumstances, and evolving laws or regulations to help ensure your plans remain aligned with your goals and objectives for their future well-being.

Roll Over An Icon To Learn More About Each Step.

Take a Candid Look™

Honestly and comprehensively assess your loved one’s current abilities, challenges, and anticipated future care necessities.

Create the Future Map™

Identify available options and outline a path to protecting your entire family’s future. Define goals, set priorities, and establish a plan for finances, long-term care, and future pivotal decisions.

Filter the Legal Options™

Consult specialized legal professionals to establish essential documents such as wills, family trusts, special needs trusts, guardianship arrangements, and powers of attorney to secure your loved one’s future care and financial security.

Capture Potential Benefits™

Research and identify the government benefits and programs available for your loved one, including Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), Medicaid, Medicare, and vocational and rehabilitation services.

Document the Wonder™

Chronicle your loved one’s journey and maintain detailed records of their medical history, preferences, abilities, and personal interests to provide valuable insights for future caregivers and support providers.

Begin the Transition™

Evaluate future opportunities for your loved one, including, transition planning services, educational opportunities, vocational training programs, employment options, and residential choices suited to their abilities and preferences.

Fund the Future™

Explore and secure funding options of special needs trusts, ABLE accounts, life insurance, and retirement planning strategies to ensure sufficient financial resources are available to meet your loved one’s long-term needs.

Review and Renew™

Regularly revisit and proactively update your care and financial plans to reflect changes in your loved one’s needs, family circumstances, and evolving laws or regulations to help ensure your plans remain aligned with your goals and objectives for their future well-being.